Quicken Overview

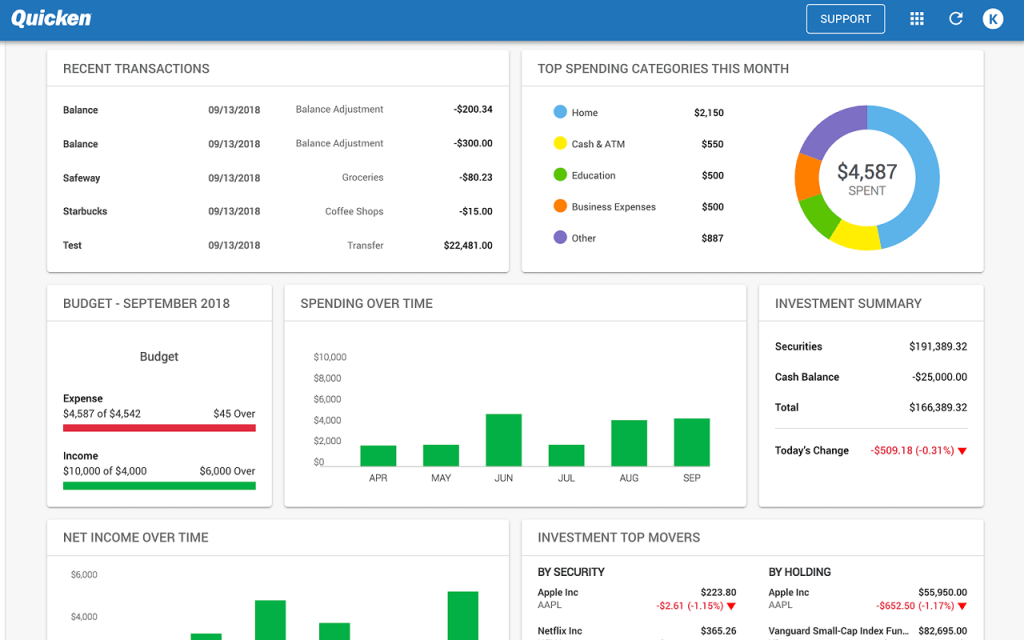

Quicken is a comprehensive personal finance management tool that helps individuals and small businesses effectively manage their finances. Here’s an overview of its key features and functionalities:

- Financial Tracking: Quicken allows users to connect and sync their bank accounts, credit cards, investment accounts, and other financial institutions to automatically import transactions and update balances.

- Budgeting: Quicken enables users to create budgets based on their income, expenses, and financial goals. It provides tools to categorize transactions, set spending limits, and track progress towards budgeting goals. Users can analyze their spending patterns and make informed decisions to manage their finances better.

- Expense Management: With Quicken, users can track and categorize their expenses, including bills, loans, and other financial obligations. It provides reminders for upcoming bill payments, helping users avoid late fees and penalties. Users can also generate reports to visualize their spending habits and identify areas where they can save money.

- Investment Monitoring: Quicken allows users to track and manage their investments, including stocks, bonds, mutual funds, and retirement accounts. It provides real-time portfolio updates, investment performance analysis, and historical price data. Users can set investment goals, track progress, and make informed decisions based on market trends and research.

- Tax Planning: Quicken integrates with TurboTax, a popular tax preparation software, to streamline the tax filing process. Users can import their financial data directly into TurboTax, minimizing manual data entry and ensuring accurate tax calculations. Quicken also provides reports and tools to help users track deductible expenses and optimize their tax planning strategies.

- Mobile and Web Access: Quicken offers mobile apps for iOS and Android devices, allowing users to manage their finances on the go. It also provides web access, enabling users to access their financial data from any internet-connected device. Data is synced across all platforms, ensuring a consistent and up-to-date financial overview.

- Integration with Other Software: Quicken integrates with other accounting software, such as QuickBooks, enabling seamless transfer of financial data between platforms.

Quicken Quality

- Features and Functionality: Quicken offers a comprehensive range of features to manage personal finances, including expense tracking, budgeting, investment monitoring, and tax planning. The software provides a robust set of tools that cater to various financial needs, allowing users to effectively manage their money.

- User Interface: Quicken’s user interface is designed to be intuitive and user-friendly, making it accessible to both novice and experienced users. The software provides clear navigation, organized dashboards, and easy-to-understand reports and charts, enhancing the user experience.

- Stability and Reliability: Stability and reliability are crucial factors in software quality. Quicken has a history of providing stable and reliable performance, ensuring that users’ financial data is accurately managed and protected.

- Customer Support: Quicken offers customer support channels, including phone, chat, and email assistance, to help users with any questions or issues they may encounter. Timely and effective customer support contributes to the overall quality of the software.

- Updates and Improvements: Quicken periodically releases updates and improvements to enhance the software’s functionality, address bugs, and incorporate user feedback. Regular updates ensure that the software remains up-to-date and meets evolving user needs.

Quicken Customer Services

- Phone Support: Quicken offers phone support for customers to speak directly with a support representative. You can find the appropriate phone number for your region on the Quicken website. Phone support is typically available during business hours, and you can get assistance with various issues and questions related to Quicken software.

- Community Forum: Quicken maintains an online community forum where users can interact with each other, ask questions, and share their experiences. It’s a helpful resource to find answers to common questions, learn tips and tricks, and engage with other Quicken users.

- Email Support: Quicken offers email support for users who prefer to communicate via email. You can submit your queries or issues through the designated email address provided by Quicken, and a support representative will respond to you accordingly.

Quicken Benefits,Advantages And Features

- Comprehensive Financial Management: Quicken provides a wide range of tools and features to manage personal and business finances in one place. It allows users to track income, expenses, investments, loans, and budgets, providing a holistic view of their financial situation.

- Budgeting and Expense Tracking: Quicken helps users create budgets based on their financial goals and track their expenses against those budgets. It categorizes transactions automatically and provides customizable reports and charts to visualize spending patterns, identify areas for improvement, and make informed financial decisions.

- Investment Monitoring: Quicken allows users to track and manage their investments, including stocks, bonds, mutual funds, and retirement accounts. It provides real-time portfolio updates, investment performance analysis, and historical price data, empowering users to make informed investment decisions.

Experts Of Quicken

- Quicken provides a comprehensive overview of your finances.

- It helps you set and track financial goals.

- The software offers various budgeting tools and features.

- Quicken syncs with your bank accounts, investments, and credit cards automatically.

- You can generate custom reports to analyze your spending and income.

Quicken Conclusion

In conclusion, Quicken is a comprehensive personal finance management tool that offers a range of benefits, advantages, and features to help individuals and small businesses effectively manage their finances. Whether it’s tracking expenses, creating budgets, monitoring investments, or planning for taxes, Quicken provides the tools and resources necessary to stay organized and in control of your financial life.

By connecting your bank accounts, credit cards, and other financial institutions, Quicken automates the process of importing transactions and updating balances, saving you time and effort. The software’s user-friendly interface, customizable reports, and charts allow for a clear visualization of your financial data, empowering you to make informed decisions.

Quicken’s integration with TurboTax streamlines the tax planning and filing process, ensuring accurate calculations and reducing manual data entry. The ability to set bill payment reminders helps you stay on top of your financial obligations, avoiding late fees and penalties.

It’s important to note that while Quicken has been a popular choice for personal finance management, it’s essential to evaluate your specific needs and preferences to determine if Quicken is the right fit for you.